Charitable Gift Annuities

Benefits of a Charitable Gift Annuity

- Receive fixed payments to you or another annuitant you designate for life

- Receive a charitable income tax deduction for the charitable gift portion of the annuity

- Benefit from payments that may be partially tax-free

- Further the charitable work of The Putnam County Community Foundation with your gift

The charitable gift annuity is perhaps the easiest and most popular way of making a contribution while keeping lifetime income. The charitable gift annuity is attractive to many people because it is a simple contractual arrangement between the donor and the Parke County Community Foundation (unlike a charitable remainder trust with a legal trust). The annuity payments are a general obligation of the foundation and this are backed by all assets of the PCCF.

Charitable gift annuities are usually purchased with cash or marketable securities. The charitable gift annuity pays a guaranteed fixed sum each year for the life of one or more beneficiaries. The Parke County Community Foundation rates follow those recommended for these annuities by the American Council on Gift Annuities. The age of the beneficiary or beneficiaries and the value of the asset used to purchase the annuity affect payment amounts.

Like other life income plans, a gift annuity generates an income tax deduction. Unlike the other life income plans, a gift annuity is treated as part gift and part purchases so that a substantial portion of each year’s annuity payment will be treated as tax-exempt income (for the length of the beneficiary’s life expectancy, as determined by IRS tables).

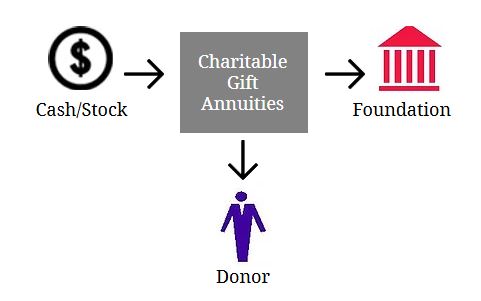

How a charitable gift annuity works

A charitable gift annuity is a way to make a gift to support the charity of your choice through the Parke County Community Foundation.

- You transfer cash or property to The Parke County Community Foundation.

- In exchange, we promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax-free.

- You will receive a charitable income tax deduction for the gift portion of the annuity.

- You also receive satisfaction, knowing that you will be helping further our mission.

If you decide to fund your gift annuity with cash, a significant portion of the annuity payment will be tax-free. You may also make a gift of appreciated securities to fund a gift annuity and avoid a portion of the capital gains tax.

Contact Us

If you have any questions about charitable gift annuity, please contact us. We would be happy to assist you and answer any questions you might have.